Community Development Financial Institutions (CDFIs) play a critical role in helping disadvantaged people and communities join the economic mainstream. To accomplish this mission, it’s just as important for CDFIs to operate efficiently so they can ensure they can maintain the necessary financial resources.

As government-certified private entities, CDFIs are 100% dedicated to delivering responsible, affordable lending to low-income consumers. CDFIs also provide financial assistance to community-based commercial borrowers. These include small businesses, microenterprises, nonprofit organizations, commercial real estate, and affordable housing.

CDFIs spark economic growth in hard-to-serve markets across the nation, and they have a target population along with a theory of change that fuels their mission. CDFIs put communities first, not shareholders. And for more than 30 years, they have had a proven track record of making an impact in those areas of America that need it most.

At the same time, CDFIs face the challenge of streamlining operations so they can operate profitably. In this blog, we examine the technology landscape and the software options that enable CDFIs to ensure they run their businesses efficiently.

Several platforms offer the potential to help CDFIs manage their end-to-end loan processes. These include origination and servicing applications bundled together as well as This is good news for CDFIs in that this technology landscape offers a lot of opportunities to improve loan process and loan performance analysis.

To understand technology trends among CDFIs, the Opportunity Finance Network (OFN) provides a commonly referenced technology survey. It’s a bit dated but shows the technology tendencies according to CDFI type, size, and other attributes, and the types of systems they use.

Some of the key findings of this survey show no one is happy with their loan servicing or CRM software! Not only are they dissatisfied with these systems but many resort to using Excel.

Other areas in which CDFIs are lacking effective technology include tracking and reporting on community development impact data in a meaningful way. This is a critical gap since CDFIs are mission-based entities that must show their clients and investors that their impact is tangible in the community.

As CDFIs take on the challenge of streamlining their operations—given their unique business model—there’s are a few software solutions can turn to. Here’s a rundown of the options:

Loan origination software manages the application, decisioning, and issuing process for lenders of various types of loans. These solutions automate large portions of the loan process and often streamline applications for borrowers by facilitating multiple processes:

Loan servicing software handles the lifecycle of loans once closed, including loan accounting from disbursement through borrower repayment of the loan. Sometimes referred to as “loan accounting” software, these solutions track the financial transactions related to the loan.

Many common loan servicing platforms handle the unique complexities of CDFI lenders as opposed to traditional banks. But some banking platforms can also be used, particularly for consumer lending CDFIs.

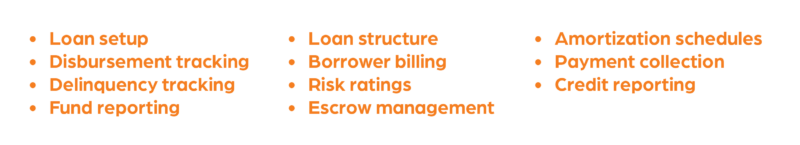

Given the complexities CDFIs face when managing participation loans, new market tax credits, non-accrual loans, borrower risk ratings, risk reserves, fund reporting, and tracking of non-financial metrics, it’s important for a loan servicing platform to deliver these key functions:

Additional key functions include covenant tracking and compliance as well as portfolio analysis, both of which are common gaps in loan servicing platforms.

Financial accounting platforms for CDFIs are similar to other industries in regards to processing AP, managing bank transactions, and general ledger functionality. But when using these solutions, CDFIs sometimes require more advanced functionality:

It’s also a good idea to not include loan-level data in the financial accounting platform since this detail appears in servicing as the sub-ledger. However, integration is often lacking between the servicing and accounting applications, and CDFIs may lack the tools to analyze and reconcile data across both platforms.

ATX helps CDFIs take on the challenges of assessing, selecting and implementing CDFI technologies. We also provide analytics software that increases the usefulness of CDFI reporting. The analytics include more visible reporting, better community development tracking, and accessible key performance indicators for tracking and business planning.

By generating accurate, real-time data, that combines data across multiple lending technologies, CDFIs have more time to focus on customers and the impact of their loans. And that increases the benefits delivered to the communities that CDFIs serve—so low-income and other disadvantaged people can join the economic mainstream.

For more information on how ATX can help CDFIs implement technologies to operate efficiently, visit our CDFI web page. You can also learn more about our solutions by reaching out to me at trey.binette@atxadvisory.com.

Author: Trey Binette